Is a Schedule C…?

Answering the web’s most searched questions about Schedule C | 5 minute read

Lots of small businesses filed a Schedule C with their tax return last year (over 24 million for the Tax Year 2024, according to IRS statistics!). But what exactly is a Schedule C? Below you’ll find answers to the internet’s most searched questions about this tax form. A clear understanding of this and other commonly confused terms can lead to more efficient communication with your tax accountant in the coming months and more confidence when speaking about your own business in general.

Read on to learn what a Schedule C is and why so many hair stylists, nail technicians, tattoo artists, personal trainers, fitness instructors, coaches, counselors, therapists, consultants and other small business operators will file them next year!

Note: I’ve linked to the IRS-hosted current-year versions of the various forms and schedules mentioned throughout this post, so if you’re curious, click through to see fillable PDFs of the exact items being referenced.

… the same as a 1040?

No. A Schedule C is not the same as Form 1040, but it can be attached to the 1040.

Form 1040 is the main individual income tax return form used by U.S. taxpayers. This is filled out by employees, business owners, students, and other individuals and families earning income. The Schedule C is an attachment to the Form 1040, specifically used by those business owners to report income and expenses from a sole proprietorship or single-member LLC.

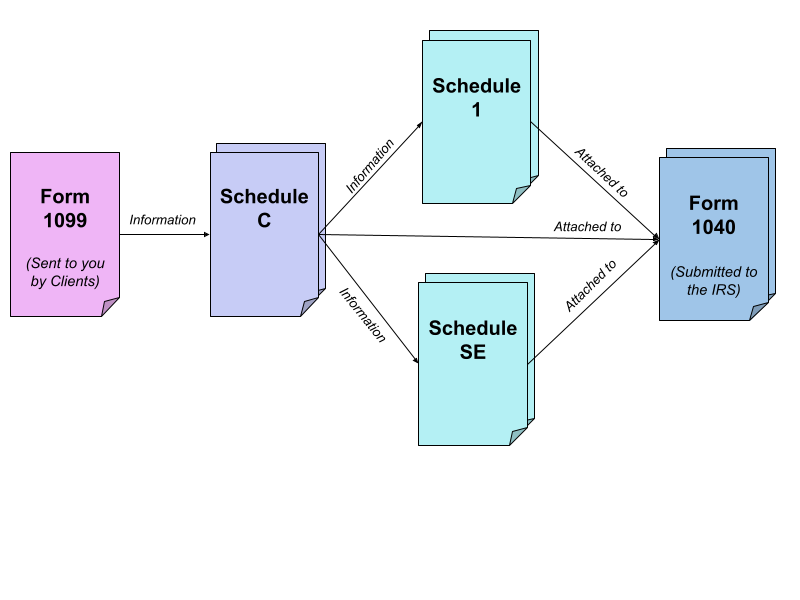

The income or loss calculated on Schedule C is carried over to Schedule 1 and Schedule SE and their results are finally entered on the first page of the Form 1040. Check out the last question in this post to see a simplified visual of how this information flows through the schedules in a tax return.

… a disregarded entity?

No. A Schedule C is not a disregarded entity, but it can be utilized by one.

A disregarded entity, like a single-member LLC or a sole proprietorship, is a business structure that the IRS "disregards" for tax purposes. This means that the entity doesn’t file its own separate tax return, but all of its income and expenses are reported on the owner’s personal tax return, usually using a Schedule C. So, while a Schedule C is the tool used to report income from a disregarded entity, it is not the same as the entity itself.

… a tax return?

No. A Schedule C is not an entire tax return on its own.

A Schedule C may be part of a complete tax return, but it is not a full return that could be filed alone. Certain business owners will use a Schedule C to report detailed information about business income and expenses and resulting profits or losses. It is a supporting schedule that, along with additional forms and schedules, is attached to the Form 1040 forming a complete tax return that may be submitted electronically or on paper to the IRS.

Note: It is a common practice for tax preparers to charge for their services “per form.” So, they might have a certain base price to prepare 1040 tax returns and charge an additional fee for attached Schedule Cs or other additional forms. One Schedule C should be completed for each small business, so individuals with multiple businesses would pay additionally under this model.

… a sole proprietorship?

No. Similar to a disregarded entity, a Schedule C is not the same as a sole proprietorship.

A sole proprietorship is a type of business structure that is unincorporated, owned by a single individual, and has no legal distinction from the owner. A Schedule C is the IRS form used by sole proprietors to report their business activity, just like with other types of disregarded entities owned by individuals. The schedule is associated with sole proprietorships, but the former is a specific form and the latter is the business type that may use the form.

… the same as a 1099?

No. A Schedule C and a Form 1099 are different types of documents.

A Form 1099-NEC (formerly Form 1099-MISC) is a form that businesses issue to independent contractors and other service providers to report payments made. In 2025, payments totaling over $600 to a specific provider must be reported, while in 2026 and beyond, the threshold has been raised to $2,000 and indexed for inflation going forward.¹ Payments are reported on the 1099 with specific copies of the form being sent to the seller and to the IRS. If you receive a 1099-NEC, the income amount reported should be included in the Gross Receipts line on Schedule C. So while the two forms are related, they serve different purposes: one reports payments made to you, and the other reports your total business income and expenses. See the graphic below for a visual representation of this relationship.

¹ H.R.1 — 119th Congress (2025-2026). Section 70433.

TL;DR

A Schedule C is a tax form used by individuals to report income from small business activities. It is not the same as a 1040, a 1099, a business structure, or a complete tax return, but it plays a vital role in the tax filing process for sole proprietors and disregarded entities.

Want to Learn More?

Not familiar with capturing all the income and expenses necessary for a Schedule C? If there’s a bookkeeping concept you'd like to hear more about, drop a comment or message with a topic you'd like to see covered.

Looking for Support?

Would you like to have your books managed by someone familiar with these concepts but just don’t have the time? A professional bookkeeper can help!